Tough economies.

The difference between Canada and Ukraine on borrowing.

Seeing the economic standstill - a lot of people's concern is growing. In places like Canada, most people are in colossal debt, and many accountants are telling their clients to consider the assets they have in case things get worse, and they need to claim bankruptcy. Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts through legal courts.

Banks are helping by deferring mortgage payments by six months. And if you are a business owner, you may be able to get a $40,000.00 loan that needs to be repaid in 8 months. The mortgage payments deferral and the 40,000.00 loans are helpful, right? Well, not much. The mortgage deferral will cost you a lot in the end, more then what it is worth as the interest piles up. And the $40,000.00 loan has very tight qualifying demands, including the payback time. That loan is available to businesses with revenues from $1,500,000.00 to $20,000,000.00 and is for payroll purposes only. One would think companies of that size would not need $40,000.00 as is it is very little to a large company.

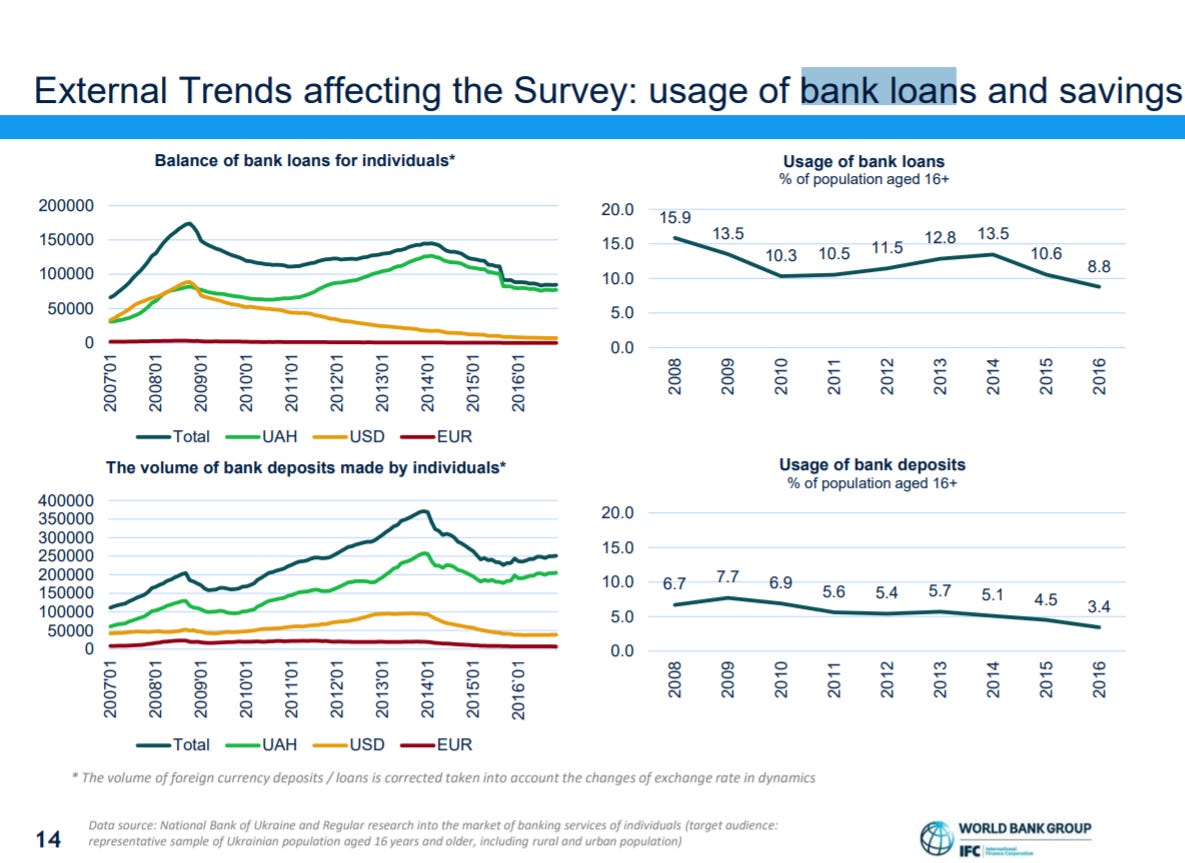

Here in Ukraine its different if you have, you will be fine, thinner but fine. But the majority are looking to find ways not to physically starve to death during this tough time. Here, most, it seams are not laden in dept (less than 16% have bank loans) but live on cash—month to month. So, the income has stopped; the rent is not going to get paid. The landlords see they are not getting paid, and eviction is a poor choice as, in reality, the current renters will pay once the flow of income starts again. Many renters foresee they can not pay and opt to move out, squeeze in with family. But it looks like the landlords are moving too slow, they should avoid this and offer the renter a deal. What if the landlord said, while you are confined in the lockdown, the rent is delayed, or deferred. What if they make way for the renter to live. When the lockdown is stopped, the renter returns to work (assuming the company did not go broke) and gets a check-in two weeks.

To me, it's about win-win. Not win-lose, not lose-win, but win-win. Or, in this case, lose-lose as there is clearly no winner during this time. I read this economic downturn is tighter than the great depression of the 1930s.

In Canada, a couple of friends have homes they rent. They pay a mortgage on the homes and rent it. Well, those renters have some compensation from the government through employment insurance. Employment insurance is where the company removes 8.7% of your gross earnings from the money you earned, and they will pay you no more then 55% of your wage if you qualify for nine months. (If you earned the minimum $15.00 per hour x 40 hours per week = $2,400.00 per month on the employment insurance, you would get $1,340.00. Now that might sound good, but it cost you $2,400.00 to live. So, where do you get the rest? One other note, don't think you can live in Canada on $2,400.00 per month; those people have two jobs and earn twice that. But the insurance pays 25% of it, and you can not live on it.

Many landlords in Canada can offer what I wrote above. But will they?

…